I’m still actually stuck on this.

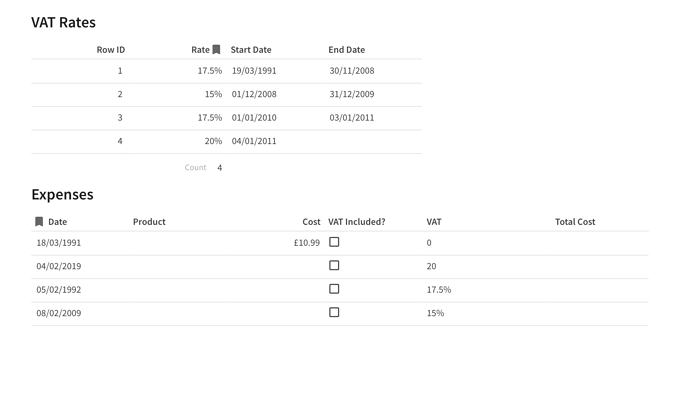

Basically, I am trying to add a receipts table, sometimes the receipt has vat included, sometimes not. I’m also trying to think ahead so that if the government changes the vat rate I can manually change it.

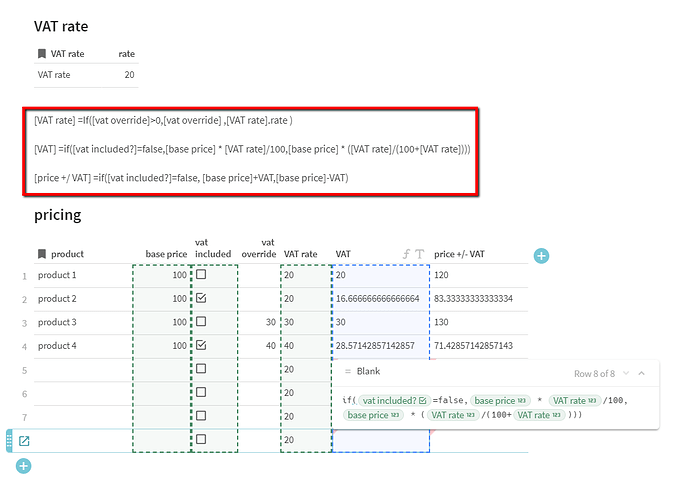

On this bases, I have the following columns.

• Is Vat Included (Checkbox)

• Cost (Manually add the amount with or without vat)

• VAT (This will calculate the vat amount, it may need to add it, it may need to take it away)

• VAT Override (The VAT formula will be based at 20%, if i add another figure here, it will override the 20%)

• Total (Cost + VAT = TOTAL)

I need my formula look to see if the VAT is included, if true then add the vat, if false then minus the vat. Now if the VAT override has a figure, I need it to override the vat rate in the formula with the one in the cell.

So far I have the following:

IF(

[Is VAT Included in the Cost?]=true,

'COST+20%',

'COST-20%',

IF(

[Is VAT Included in the Cost?]=true,

[VAT Percentage].IsNotBlank(),

'VA+20%',

),

IF(

[Is VAT Included in the Cost?]=false,

[VAT Percentage].IsNotBlank(),

'VA-20%',

)

)

(Ignore the actual calculations, I was just trying to make it easier to read)

The third if statement I believe is needed because, if [Is VAT included] = true and [VAT Percentage] = 40% the second IF statement will work, but if [Is VAT included] = false, then it would break.

I’ve tried all lnight trying to get this to work and I keep getting errors. I had this nailed in Airtable but I can’t quite figure out Coda yet. It would help if they had actual examples in the formula docs.